I sat in on Brian Buffini’s Real Estate market report today and it was very interesting. Here are a few notes.

I sat in on Brian Buffini’s Real Estate market report today and it was very interesting. Here are a few notes.

The dollar value is at 100%.

Job market low.

Utah and Idaho are the same as they have been open.

These who are working are doing more.

Help wanted signs everywhere.

Inflation – core inflation – excludes food and volatile fuels, rising at the highest pace in 30 years.

Plays into real estate, fixed assets, with fixed payment, more demand for real estate than ever before.

Seeing a 4-7% rent increase.

Mortgage is fixed, great in terms of getting family finances. Asset price houses are rising. Strongly.

Where will we finish the year in transaction, highest 6.1 million? Seeing some topping out. Approaching pre-pandemic levels, past the surge.

Picked out 2 2x4s worth more than the contractor’s labor.

Inventory in 6 months will be better – we are passed the acute shortage of inventory.

New construction – more more housing permits.

Mortgage forbearance, phased out, we hope they can find a job and become current. Will have to sell. Probably not foreclosure, but added inventory.

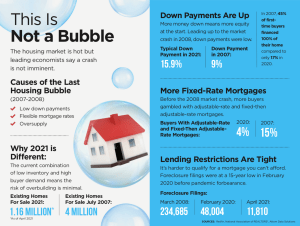

Most asked question on Google is this a bubble?

Why is this different?

Look at inventory. 1.2m homes now, last time we had 4 times the amount of homes on market.

Second – no shady, risky mortgages. Immune to policy changes.

Bubble? No – with a bubble you see runaway price increases, lower downs, adjustable rate mortgages.

Now – prices rising, 2x down payment, rates are fixed, more equity, locking in low rates on 30 year fixed.

Given the 20% price increases, Could it decline? Of course, but not persistent. Have an army of buyers who have been outbid. Don’t expect a persistent price decline. Second chance opportunity for those that have been outbid.

Rental price increases will feed into demand and rates are going to stay low.

Pent up demand to move – older folks were put off do to Covid.

Those who put off moving might add to inventory now.

What we are seeing the is the number of new cases of Covid are down, people feel better about inviting strangers to their house, and dining indoors. Older people will list their homes without fear.

Migration pattern from high tax states such as CA and NY. More acuteness of the tax differential between states.

San Diego – of the 7 taxes, 6 highest, but it is always 70 degrees.

Realtors knowledge about market condition helps with a better acceptance of an offer.

On the selling side the median is 17 days, if over 30 days something is wrong. Don’t overprice to begin with.

Next year a percentage increase.

Top three Google searches where is where the rubber meets the road:

When is the housing market going to crash – doubled last week.

Why is the market so hot – up 350%

How much over asking price should I offer?